Table of Contents

ToggleMaximizing Financial Clarity: Understanding Landed Cost and Its Categories.

Acquire in-depth knowledge about the realm of landed cost and its various classifications through SuitePedia’s expert assistance within the NetSuite platform. Explore the intricacies of financial transparency, enabling informed decisions and efficient business management.

What is Landed Cost?

The total cost of obtaining stock includes the material charge for an item. It encompasses all fees linked to bringing products into the warehouse and preparing them for sale. These extra costs add to the overall cost of goods sold and influence the valuation of inventory.

Utilize the Landed Costs functionality to monitor the costs you encounter during the acquisition of your inventory. By incorporating additional charges like shipping and customs fees, landed costs enhance the asset valuation of your inventory.

Expenses that contribute to landed costs can include the following:

· Shipping charges

· Freight fees

· Origin and destination charge

· Duty fees (excise and customs)

· Import fees

· Taxes

· Insurance

· Handling charges

Any landed cost associated with an item is added to the asset value of an inventory item, letting you calculate profitability accurately.

Reporting

The inventory valuation report can be customized to include the Lot/Serial Numbers field. The landed cost charges show with the same transaction ID number, the landed cost category name in the description column and zero quantity.

Landed Cost Categories

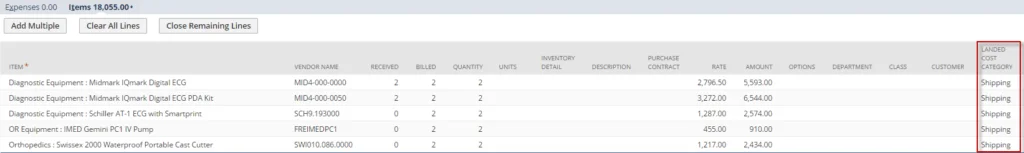

You have chosen the items for which you want to track landed cost. Now, you can create landed cost categories to track the different kinds of expenses incurred when purchasing.

For example, one category can be called Freight Truck Expenses, and another called Courier Expenses.

Typical landed cost categories include the following:

· Shipping charges

· Freight Costs

· Import Fees

· Customs and Duts

· Taxes

· Insurance

· Handling Charges

Each landed cost category you create is associated with a expense account that is intended as a holding account. The value is ultimately cleared between landed cost allocation and the vendor bill entry.

Note

This account is usually not a Cost of Goods Sold (COGS) account. The COGS entry is made during the item fulfillment process. It is common to use special accounts for landed cost expenses that are separate from regular expenses. This provides an easier audit trail.

After categories are created, you can select them for items on transactions.