Seamless Tax Administration: NetSuite's Guide to Addressing Landed Costs and Taxation.

Delve into SuitePedia’s comprehensive instructions within NetSuite for effectively managing landed costs and taxation. Acquire detailed strategies to navigate various tax categories, promoting enhanced financial oversight for your enterprise.

Managing Landed Costs and Taxation: A Guide

Within the NetSuite platform, various default tax categories are pre-configured. When expanding operations to a new country by adding a subsidiary or establishing a Nexus, additional tax categories become available. Moreover, individuals with administrative privileges or those from NetSuite Professional Services have the capability to configure new tax structures.

When the cost source is based on Other Transaction (exclude tax), the tax calculation depends on whether you use Legacy Tax or SuiteTax.

The following information explains the effect of taxation on the landed cost when using other transaction as source.

Legacy Tax

- Source is Other Transaction – GST and VAT taxes are excluded. Sales taxes are not present on transactions and are excluded.

- Source is Other Transaction (exclude tax) – All taxes are excluded.

Suite Tax

- Source is Other Transaction – All taxes are included.

- Source is Other Transaction (exclude tax) – All taxes are excluded.

Landed Cost Examples

The following use case examples describe tracking landed costs.

1. Landed Cost and Items Billed Separately

You use a freight company to deliver inventory items you need. For each shipment, you receive two separate bills. One from the vendor that charges you for the items. One from the freight company that charges you only for transporting the items.

See the following examples:

a. Landed Cost Billed Separately with Advanced Receiving

See the following example of landed cost billed separately with Advanced Receiving.

Note

This example is not applicable for Standard Cost items.

To bill landed cost separately with Advanced Receiving:

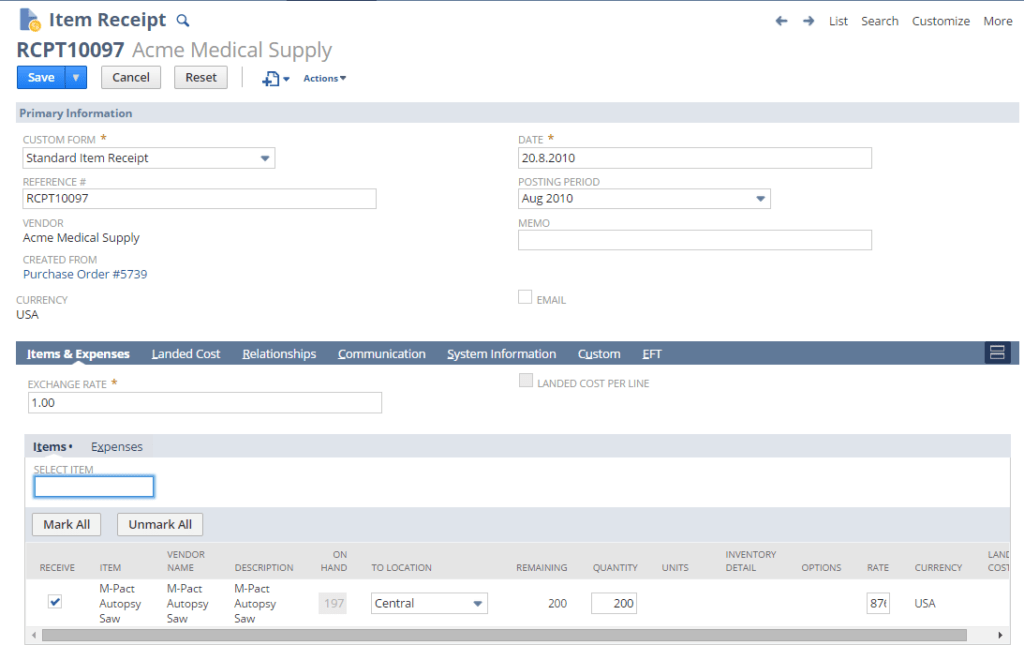

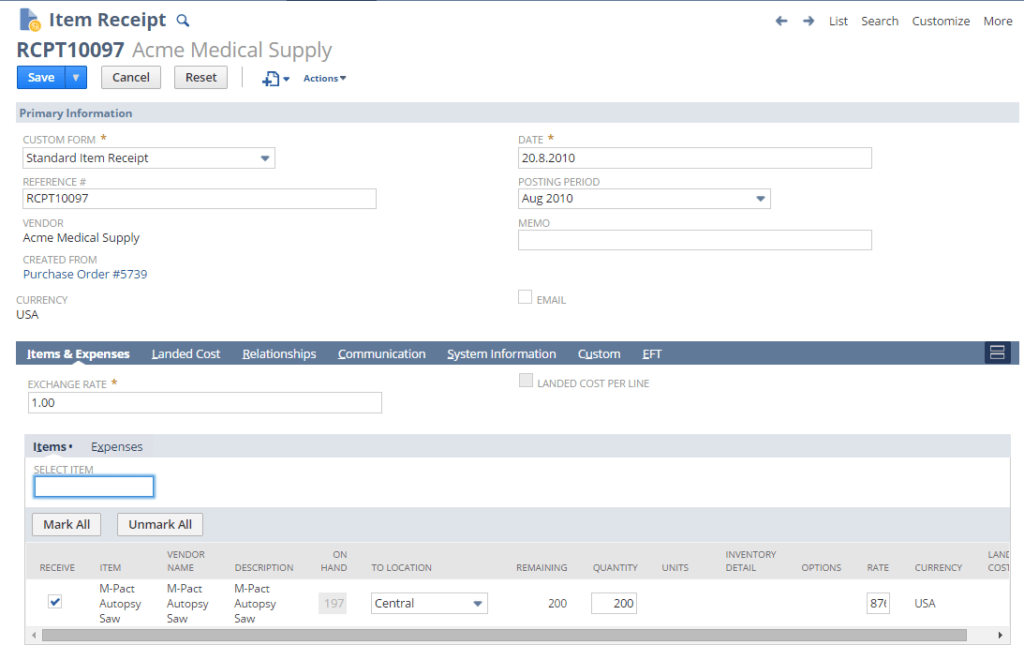

1. Enter the item receipt against an existing purchase order that includes an item that tracks landed cost.

The freight bill has not arrived, so no information is entered on the Landed Cost subtab yet.

The entire amount of the landed cost bill is applied to the receipt even if you do not receive all items on the order.

2. After you receive the freight bill, enter the freight charge as a vendor bill.

When entering the bill, click the Expenses and Items subtab and select a landed cost item on the Items subtab of the bill. Because you are not entering any inventory items, select a landed cost item such as Freight.

3. Be sure to select a landed cost category for each line-item you enter. For example, if you select the landed cost item Freight, select the landed cost category Shipping. Selecting a category determines where the bill appears as a Transaction source on the Landed Cost subtab. For example, you select the category Shipping. This vendor bill appears in the Transaction source list for the Shipping category. It does not appear in the list for the Duty category.

4. Enter reference information in the Memo field of the bill header. The memo text appears in the Transaction list when you are selecting a source transaction. You can also search for memo text in the transaction list.

5. Edit the item receipt you entered in step 1. On the receipt, identify the freight charge as a landed cost for the items on the receipt by clicking the Landed Cost subtab.

6. A line appears for each landed cost category. Next to the Shipping category, select Other Transaction in the Source field. The Transaction field will appear next to the Source field.

7. In the Transaction field, click the List button to open a list of transactions that include items associated with landed costs for this category. Select the vendor bill you created in step 2.

Keep in mind the following about the transaction list:

- Transactions associated with other landed cost categories DO NOT show in this list.

- Bills show only if they are not yet allocated to another item receipt.

- You can search for keywords or memo text to find the correct bill.

- This list can include both Open and Paid bills.

8. Click Save.

After you save the edited receipt, the entire amount of the bill is applied as a landed cost. You cannot apply a partial amount.

b. Landed Cost Billed Separately with a Cost Estimate

See the following example of landed cost billed separately with a cost estimate.

Note

This example is not applicable for Standard Cost items.

To bill landed cost separately with a cost estimate:

1. Medical supplies are received against a purchase order. The freight charges are commonly not known before the freight vendor’s bill is received.

Note

Items are purchased from a supplier and the shipping charges to be allocated as landed costs are billed separately.

The General Ledger (GL) Impact appears as follows after entering the receipt:

2. If landed costs are not known at the time of receipt, enter an estimated amount. For example, after the initial item receipt, the warehouse staff are responsible only for the inspection and receipt of quantities. The warehouse staff then forwards any documentation to the accounting employees who can edit the transaction and enter estimated landed cost values.

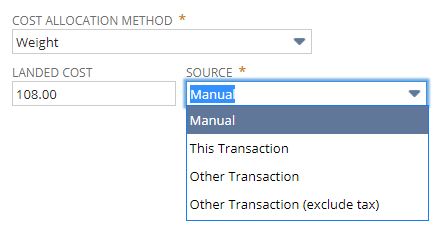

The value entered can be allocated using one of the following methods:

- Weight

- Quantity

- Value

The value can be sourced in one of the following methods:

- Manual – The user enters the value manually

- Other Transaction – Another transaction is the source of the value

- Other Transaction (exclude tax) – Another transaction is the source of the value, excluding taxes

Note

When the cost source is based on Other Transaction (exclude tax), the tax calculation depends on whether you use Legacy Tax or SuiteTax.

The amount is entered manually, and the receipt saved. In this example, a $25 Freight landed cost to be allocated by weight is added:

The GL Impact shows the following entries for landed costs:

- The Memo field includes the landed cost and item code to display the exact allocation details.

- The value of the landed cost is now included in the inventory asset total. Because the freight expense account is a holding account, the amount is credited on the receipt. Later, when the vendor bill is entered, the same value is debited to this account to offset to zero.

Account | Amount (Debit) | Amount (Credit) | Posting | Memo |

Accrued Purchases |

| 125.00 | Yes |

|

Inventory Asset | 100.00 |

| Yes |

|

Inventory Asset | 25.00 |

| Yes |

|

Inventory Asset | 11.43 |

| Yes | Freight Charge RW001 |

6000 Freight and Delivery |

| 11.43 | Yes | Freight Charge RW001 |

Inventory Asset | 8.57 |

| Yes | Freight Charge BW005 |

6000 Freight and Delivery |

| 8.57 | Yes | Freight Charge BW005 |

Inventory Received Not Billed |

| (125.00) | Yes |

|

Inventory Asset | 100.00 |

| Yes |

|

Inventory Asset | 25.00 |

| Yes |

|

Inventory Asset | 11.43 |

| Yes | Freight Charges: RW-001 |

6090 Freight and Delivery |

| 11.43 | Yes | Freight Charges: RW-001 |

Inventory Asset | 8.57 |

| Yes | Freight Charges: RW-006 |

6090 Freight and Delivery |

| 8.57 | Yes | Freight Charges: RW-006 |

3. The freight bill is received from the vendor. The amount may be different than the estimated landed cost entered. The landed cost amount is entered on the Item subtab of the vendor bill with the specific landed cost item, such as Freight.

Landed cost vendor bills can be entered as a multiple shipment summary or a single shipment.

Option One: Summary Bill

Enter this bill as a summary of one vendor’s charges across a period, such as a week or month, for many different shipments completed.

- Enter the bill and do not fill in the Landed Cost Category column.

Account | Amount (Debit) | Amount (Credit) | Posting | Memo |

2000 Accounts Payable |

| 24.00 | Yes |

|

6090 Freight and Delivery | 24.00 |

| Yes |

|

2. The GL impact shows correctly with a DB to Expense.

3. Edit the item receipt and update the landed cost amount to the true value. Leave the Source set to Manual.

4. The GL Impact is updated to reflect the new value

Account | Amount (Debit) | Amount (Credit) | Posting | Memo |

Accrued Purchases |

| 125.00 | Yes |

|

Inventory Asset | 100.00 |

| Yes |

|

Inventory Asset | 25.00 |

| Yes |

|

Inventory Asset | 13.71 |

| Yes | Freight Charge RW001 |

6000 Freight and Delivery |

| 13.71 | Yes | Freight Charge RW001 |

Inventory Asset | 10.29 |

| Yes | Freight Charge BW006 |

6000 Freight and Delivery |

| 10.29 | Yes | Freight Charge BW006 |

Option Two: Single Bil

Enter a vendor bill specific to only one shipment

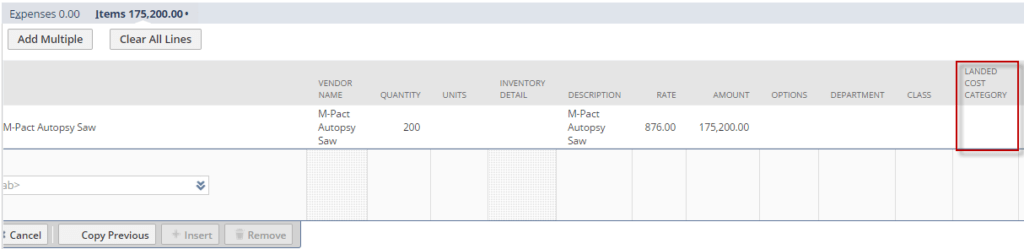

5. Enter the vendor bill and be sure to use a landed cost item.

Note

To let this transaction be sourced to the inventory item receipt using the correct landed cost type and amount, complete the Landed Cost Category field

To let this transaction be sourced to the inventory item receipt using the correct landed cost type and amount, complete the Landed Cost Category field

6. Edit the item receipt and change the Source field to Other Transaction or Other Transaction (exclude tax).

7. In the Transaction field select the Vendor Bill. The transaction amount is populated into the Landed Costs Amount field. The transaction column displays Null if the reference field on the bill is not populated.

8. The GL Impact is updated to reflect the new value.

If some of these items have already been sold, the inventory costing impact on the fulfillments will be updated to include the new value

You can choose to add the Expense Category field to show on the expense sublist of purchase transactions. Then, line-item expenses can be grouped by category. When you choose a category in the expense sublist, the account defaults from the category record and cannot be changed.

The following transactions can be customized to show expense categories:

· Checks

· Bills

· Vendor Credits

· Purchase Orders

· Expense Report

To customize a transaction, view the transaction and click Edit. Then, in the Customize list, click Customize Form.

2. Landed Cost and Items Billed Together

Your vendor delivers inventory items you need. For each shipment, you receive one bill that charges you for both the cost of the items and a shipping fee for sending the items. You need to track the shipping fee as a landed cost.

The correct steps to track landed costs depend on whether you use the Advanced Receiving feature in your NetSuite account.

a. Landed Cost Billed Together With an Inventory Item on One Bill With Advanced Receiving

The following example shows how landed cost can be billed along with an inventory item on one bill with advanced receiving.

The correct steps to track landed costs depend on whether you use the Advanced Receiving feature in your NetSuite account.

Note

This example is not applicable for Standard Cost items.

To bill landed cost together with an inventory item on one bill with advanced receiving:

1. When the items are delivered, enter the item receipt.

2. Verify that item records for the appropriate items on the receipt are marked Track Landed Cost.

3. When you receive the bill from the vendor, edit the purchase order to add a landed cost item for the amount of the delivery fee.

On the Landed Cost subtab of the purchase order, select This Transaction in the Source field next to the appropriate category.

Make this selection to source items on this transaction to calculate the landed cost amount for this category. The total landed cost amount is the sum of amounts for all items on this bill or receipt associated with this landed cost category.For example, you enter an item receipt that includes 2 inventory items associated with Duty landed costs and 2 associated with Shipping landed costs. If you select This Transaction for the Shipping category, the landed cost is the sum of the 2 inventory items amounts associated with Shipping. The Duty items are excluded.

Note

This option is available only on transactions when you do not use Advanced Receiving. If you use Advanced Receiving, the allocation must occur on the inventory receipt transaction

4. When you save the edited purchase order, the landed cost is allocated as indicated.

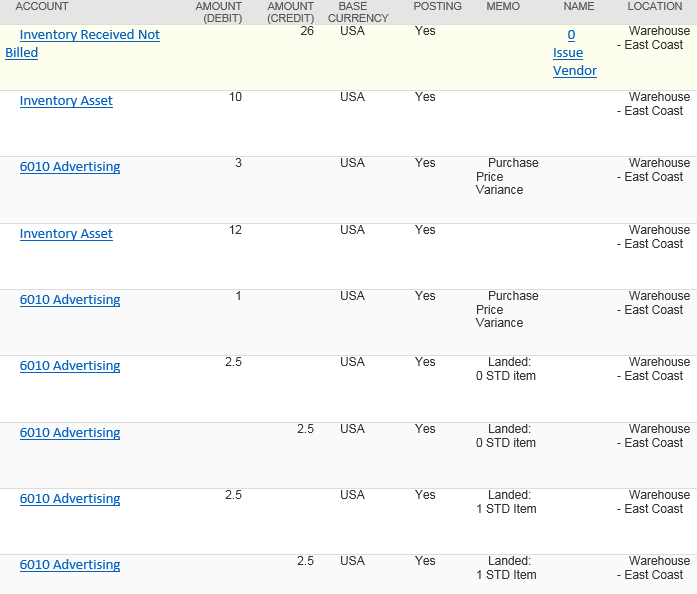

3. Landed Cost with Standard Cost Items

Two standard cost items are marked to use landed cost.

- Item 1: standard cost = 10 x Quantity = 1

- Item 2: standard cost = 12 x Quantity = 1

- On a receipt, for each the rate = 13 (total 26)

- Inventory Received Not Billed account = (-13 x 2)

- Item 1 Asset = 10

- Item 1 Variance = 3 (13 – 10)

- Item 2 Asset = 12

- Item 2 Variance = 1 (13 – 12)

For landed cost:

- one item is used (6010 Advertising)

- entered $5 with allocation method = Quantity

The $5 is allocated evenly.

Note

Always refer to the official NetSuite documentation for detailed and specific guidance based on your NetSuite version. Additionally, you may want to involve your NetSuite administrator or seek assistance from NetSuite support for any specific challenges you encounter during the setup process.