Table of Contents

ToggleDiscover MerchantE: Payment Solutions Provider and Platinum SuiteWorld Sponsor

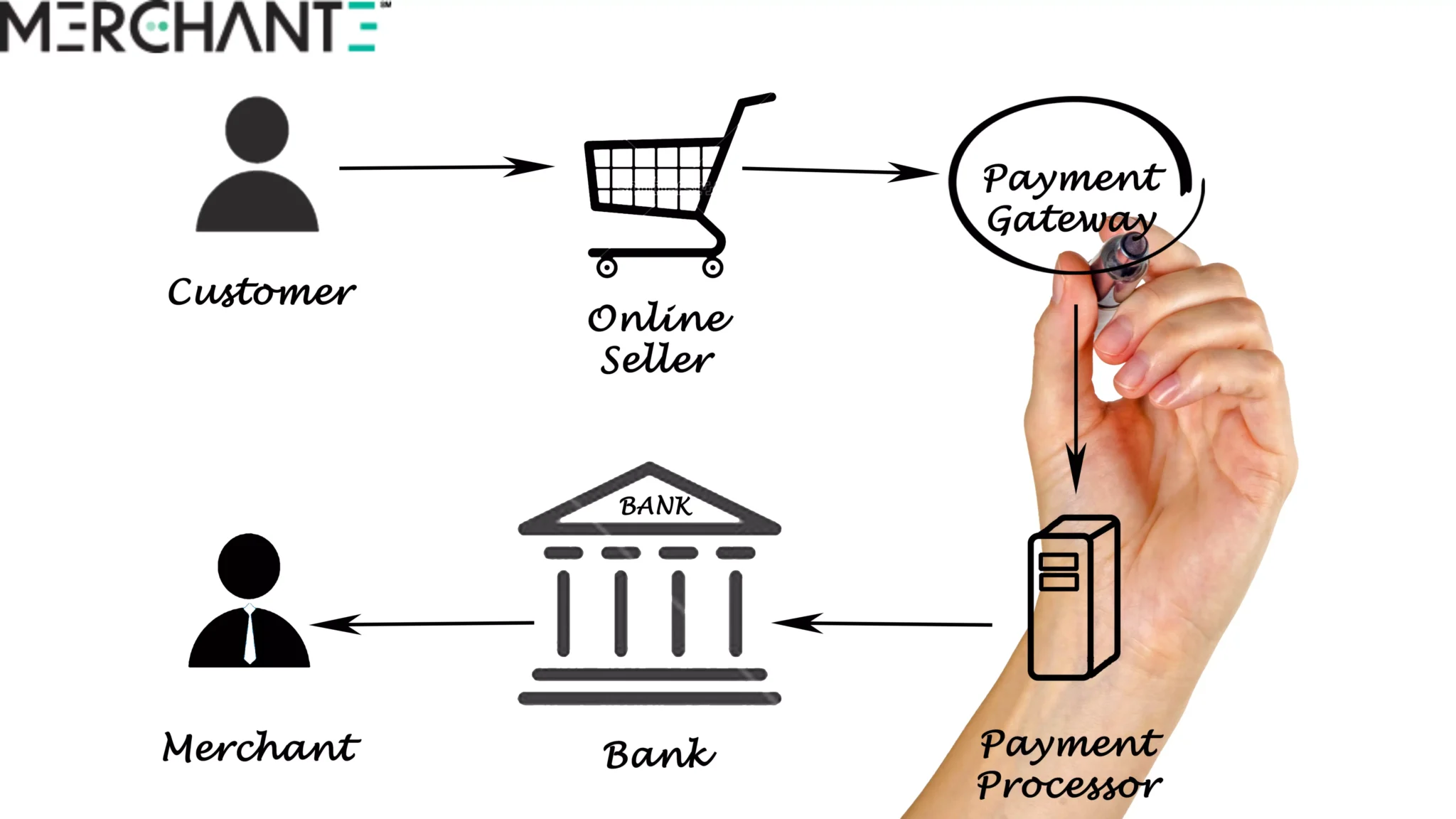

With the business landscape constantly in a state of flux, organizations need to innovate and take advantage of new technologies. MerchantE is one such innovation in the payment processing industry which has managed to get the attention of businesses all over the industry. MerchantE as the leading end-to-end payment solution provider, offers a comprehensive suite of services with broad category depth and scalability to meet small, medium and large enterprise needs. Read along and understand why MerchantE is a game-changer for businesses of today and learn about its SuiteWorld sponsorship.

Understanding MerchantE

For over 20 years, MerchantE (previously known as Merchant e-Solutions) has been one of the major players in the merchant processing industry. The user-friendly interface allows merchants of all sizes, from newly launched startups through to large ventures based in the U.S., access to a suite of robust business solutions which serve their customers. MerchantE is headquartered in Alpharetta, Georgia. The company is on a mission to provide new and integrated payment solutions for businesses across the digitizing world helping them grow seamlessly & successfully.

Payment Solutions offered by MerchantE

1. Money IN: MerchantE is a complete solution that enables fast and efficient payment processing from beginning to end. Everything is supported from Visa, Mastercard and American Express to Discover, JCB UnionPay or ACH Payments with MerchantE handling them all effortlessly. It provides an affordable, safe and transparent transactions within a distributed web reducing costs while eliminates all middlemen. Features of Money IN:

- Multi-Channel Payment Acceptance: MerchantE provides comprehensive in-store and out-of-home payment acceptance options that support a variety of customer-preferred payments including major credit cards and ACH transactions. As the current market is very customer driven, being able to deliver a great experience will result in more sales and happier customers.

- Digital Transactions: MerchantE Offer the highest standard of security possible. With advanced encryption and tokenization technologies securing sensitive payment data, the platform ensures secure transactions that comply with industry standards like PCI DSS.

- Competitive Processing Rates: MerchantE can provide some of the lowest credit card processing rates around, particularly for smaller to medium-sized businesses. The more cost-efficient integration means that businesses can utilise their profit margins by lowering payment processing costs.

- End-to-End Processing: Manage your entire payment stream, no intermediaries mean fewer fees and more efficient troubleshooting. The approach is directed which helps in cost-reduction and increases the overall reliability & speed of payment processing.

- Support High-risk Merchants: If you run a business in the high-risk sector, such as CBD and online gaming then MerchantE gets your back. This means that businesses with more tailored needs can still access safe and effective payment processing.

2. Money OUT: It is important to streamline when and how businesses pay vendors & employees. MerchantE offers multiple options to customize mass payout programs, helping them in improving cash flow allowing streamline financial planning for businesses around the world. Here’s how Money OUT makes the difference:

- Flexible Disbursement Options: MerchantE provides different disbursal methods such as ACH Transfers, Wire Transfer and even Check Payment. Businesses are free to choose the best way for each transaction and manage cash flow more efficiently.

- Efficiency in Payroll Processing: Handling payroll can be a complicated and time-consuming affair. MerchantE will automate payroll disbursement and make employee payment timely and accurate. This eliminates manual effort and reduces errors.

- Vendor payments: This one is pretty much a no-brainer, paying your vendors helps you maintain good business relationships and operations. The frequency of vendor payments through MerchantE’s platform allows businesses to pay vendors on time and stay in good standing, thus avoiding late fees and maintaining a good reputation.

- Expense Management: MerchantE offers a powerful tool that enables businesses to monitor and manage their business expenses, so as to help companies control the way another company your money is spent on. A holistic approach to expenses equips businesses with all the information they need to make smarter choices and streamline their costs across departments.

3. Money MAX: Growth tools are important for businesses seeking to scale up. MerchantE delivers unique cash flow maximizing services to business, providing the insights and tools they need for faster, smarter growth. Characteristics of Money MAX:

- Advanced analytics: The MerchantE platform includes advanced customer insights into the payment data it processes. Sales trends to monitoring customer behavior and even analyze financial performance for making decisions based on data that drive growth.

- Optimizing Cash Flows: Getting a good grip on cash flow management is crucial to business expansion. Some things you could look forward to from MerchantE include automated invoicing and payments reminders. These functionalities are designed to help businesses get paid faster, and thus better preserve their cash.

- Scalable Solutions: As a small business grows, its financial needs also evolve. MerchantE works with businesses to ensure their financial capabilities and processes are scalable, meaning they can rapidly advance without the fear of maxing out on your solutions. It is this scalability that ensures MerchantE remains a valuable partner at every stage of the business lifecycle.

- Business Tools Integration: MerchantE seamlessly integrates with leading business tools, like Oracle NetSuite, to deliver enhanced functionality and unified financial management experience. This is where the integration scheme comes into play for efficient operations and greater focus on business growth.

- Customer Service: Customer Support is one of MerchantE’s key selling points. This means that you can trust their team of experts to help with any problems or queries if a business is looking for predictable, high-speed assistance consistently as they scale up.

MerchantE for Merchants

- Enhanced Customer Experience: Businesses that offer multiple payment options and secure, fast transactions can improve the overall customer experience. But of course, a satisfied customer will keep on coming back and recommending others to do the same which in return contributes towards business growth. With MerchantE customers stay content.

- Increased Efficiency: As the interface is user-friendly, with MerchantE integrated solutions removing the need for so many payment processors make operations far simpler and more effective. Merchants have the power to manage all their payment operations from a single platform without requiring any scheduling.

- Scalability: With Payment Processing Evolution businesses looking to scale simply need solutions that can change as fast as their requirements and don’t worry the payments processing would become a bottleneck for business growth are just some of what MerchantE offers with its scalable payment solution.

- Cost Savings: MerchantE offers businesses competitive pricing and lower processing fees. Businesses never have to worry about hidden fees; the company employs a transparent pricing model where they know what businesses are paying upfront.

SuiteWorld and MerchantE

Disclaimer:

The logos used on this website are the property of their respective owners. These logos are provided for informational purposes and to represent the entities or organizations mentioned in the content. Their inclusion does not imply any affiliation or endorsement unless specifically stated.We make no claim of ownership to the logos nor do we assert any right over them. Any use of third-party logos is purely for illustrative purposes. If you are a representative of the entity whose logo appears and wish for it to be removed, please contact us directly and we will promptly comply with your request.